Feature / Reading the numbers

The latest NHS finance function census shows yet again that the number of finance staff has remained relatively stable despite last year’s restructuring and the move to system working. But with increasing pressure for new integrated care boards (ICBs) to cut running costs, the figures effectively provide a new baseline for NHS finance staff against which future staffing levels will be judged.

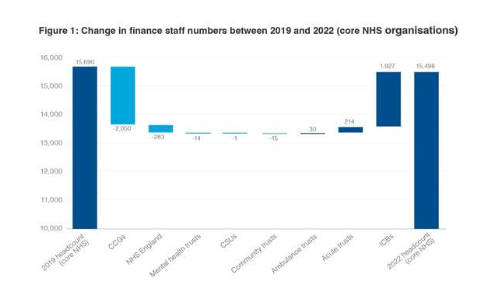

The new census – a collaboration between the HFMA and the Skills Development Network – reports the number of finance staff in place at the end of September 2022, three months after ICBs were created. Total headcount across the core NHS (providers, ICBs, the four remaining commissioning support units and NHS England) is 15,498 – down slightly from 15,690 in 2019, the last time the census was undertaken (see figure 1).

The NHS finance function in 2022: England also reports a bigger figure of 16,482, which includes finance staff in arm’s length and other non-core bodies such as Health Education England, the National Institute for Health and Care Excellence and NHS Property Services.

Of the core finance staff, 82% work in provider trusts, 12% in ICBs. The remainder are split more or less equally between NHS England and commissioning support units.

Within this there was a small increase in the number of finance staff working in providers, up 215 to 12,760. At the same time, the 2,050 number of finance staff working in the 191 clinical commissioning groups in 2019 has fallen to 1,927 in the 42 new ICBs. There are also 283 fewer staff in NHS England.

The organisational structure is very different to that in 2019. There are 14 fewer provider organisations. But the major difference is the change in the commissioning landscape. The 191 CCGs at the time of the last census had merged into 106 by last summer, with their functions transferring to the 42 new ICB system leaders.

The relative stability in finance numbers before and after the system reorganisation is not surprising, given the employment commitment made to all affected staff below board level. However, with ICBs being asked to reduce running costs by 20% in 2024/25 and 30% in 2025/26 – real-terms cuts compared with current running cost allowances, which were already held flat in cash terms this year – there will be significant pressure on all ICB departments to reduce headcount.

Emma Knowles, HFMA director of policy and communications, says it will be difficult for boards to reduce finance staff numbers considering the agenda they face. The number of finance staff has remained broadly the same for the past seven years, increasing by just 100 over all frontline bodies (providers, commissioners and ICBs).

‘There is a huge agenda in NHS finance and the total funding continues to increase, despite there being fewer organisations,’ she says.

‘There may be opportunities for organisations to share some back-office costs with others in their system. And robotic process automation could free up some finance staff time. But there is also a need for finance to support pathway redesign, the elimination of unwarranted variation, and changes in allocation to target greater prevention and the reduction of health inequalities.

‘In providers, the efficiency and productivity pressures remain enormous and finance staff have a major role to play in the digital agenda and supporting investment in the wider NHS estate. And, for example, there is a need for more, not fewer, finance staff to support the compilation of robust patient-level costing data and to start to use that data more to drive improvement.’

The census is the first opportunity to look at how finance staff are shared out across the 42 new systems. Three ICSs – Greater Manchester, North East and North Cumbria, and Cheshire and Merseyside – account for nearly a fifth of the 14,687 finance staff working in ICBs and providers.

At the other end of the scale, nine systems have fewer than 200 staff in finance, with two – Somerset and Frimley – having fewer than 100.

The difference in finance numbers is clearly influenced by the size of system involved – populations range from 3.2 million in Manchester to just 520,000 in Shropshire, Telford and Wrekin. And the number of providers in each patch ranges from Frimley with a solitary provider to Cheshire and Merseyside hosting 17.

How different organisations deliver their financial services – including the use of outsourced or shared services – will also have an impact on the reported finance function sizes. The number of places within each system will also affect board finance numbers, with different support arrangements likely to lead to different structures – although these may not have fully bedded in yet.

Inevitably there is a strong link between the financial size of an organisation and the size of its finance team. Average numbers of finance staff in an ICB, for example, ranged from 92 for organisations overseeing system allocations of more than £4bn, down to 30 for ICBs with allocations of less than £2bn.

The same obvious trend can also be seen across providers. The smallest trusts financially (turnover of up to £250m) had an average of 28 staff in their finance teams, while the biggest trusts (turnover of more than £1bn) had 145. But again, smaller organisations may buy in services while larger providers provide some shared services for local organisations.

On average, mental health trusts have smaller finance teams than acutes in similar turnover brackets. Community trusts have smaller numbers again and ambulance trusts typically have the smallest teams.

Outsourcing will have a big impact on the numbers of finance staff in different organisations, making direct comparisons of numbers difficult. Outsourcing of financial services is widespread, with only one ICB and 23 providers reporting no outsourcing. For providers, internal audit is the most frequently outsourced service, with 83% of all trusts buying in the service. But nearly 60% also outsource payroll. One in four trusts outsource all of internal audit, payroll, accounts payable and accounts receivable. All but two of the 42 ICBs outsource payroll, while the vast majority also buy in internal audit.

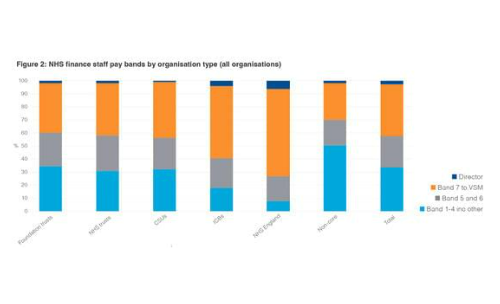

The finance function continues to be relatively senior (see figure 2). Looking at the whole function (core and non-core), 43% are agenda for change band 7 or higher (including directors and staff on the very senior managers’ pay framework). London again has the highest proportion of senior staff, with 55% of finance staff band 7 or higher. This may be related to the higher cost of living in London requiring appointments to be at a higher banding. The North East region has the lowest proportion of staff at band 7 and above at just 35%.

ICB finance teams are weighted towards senior roles – 59% of ICB finance staff are band 7 or above, compared with 40% in providers. And nearly three-quarters of NHS England staff are at band 7 or above.

The census reveals there are 380 people at director level in finance across the core NHS, covering 266 organisations including NHS England regional offices. The mismatch between director numbers and the number of organisations may be because of an increasing tendency for organisations to have an executive finance director or chief finance officer at board level, with other non-board directors reporting to the executive director.

In group trusts, there can be a group finance director plus individual hospital finance directors. The 42 ICBs reported 83 director-level finance positions. More than half the overall finance function work in financial management, which covers financial planning, management accounts, performance, commissioning, contracting and costing. A quarter work in financial services – functions such as payroll, audit and financial systems – and nearly one in five work in financial accounting – accounts payable and receivable, treasury activities and statutory accounts.

Reflecting the levels of seniority in the function, finance staff are also highly qualified. Nearly two-thirds of staff have – or are studying for – some form of finance qualification, a six percentage point increase on 2019. Some 30% of staff have a CCAB qualification or equivalent, while 13% are working towards such a qualification.

CIMA remains the dominant NHS finance qualification, making up 43% of the 7,076 with or studying towards a CCAB or equivalent qualification. A further 36% are ACCA- qualified/students, while CIPFA and ICAEW account for 11% and 5% respectively.

Diversity in finance

One NHS Finance has focused on diversity in finance departments in recent years and the census now collects more information in this area. Women continue to make up more than 60% of the finance workforce – a similar proportion to 2019 and 2017.

This split continues not to be reflected at senior manager and director level. Just 34% of all directors are women, although this is a big improvement since the 2019 census, when the figure was 29%. At the new ICBs, women represent 42% of all finance directors compared with 31% of clinical commissioning groups back in 2019.

Looking at the organisations that make up the core NHS, women represent more than half of the function up to and including band 8B. But from band 8C onwards women make up a reducing proportion of the finance team – ranging from 48% at band 8C to 42% at band 9 and 34% at director level.

There is also variation across the country, with the proportion of male staff at director level ranging from 60% in the North West (69% in 2019) to 75% in the East of England (78% in 2019).

Overall, the NHS finance function appears to reflect the ethnic profile of the population as a whole. According to the national census for England and Wales, nearly 82% of the population is white. The finance census shows that the split across the whole English function is 77% white compared with 23% other ethnicities (organisations chose not to disclose the ethnicity for 5% of finance staff, so census figures are based on disclosed numbers).

However, this split is starkly different as you move up the agenda for change pay bands. Among band 2 staff, 25% are from another ethnicity, but this falls to 17% at band 8d, 11% at band 9 and 8% at director level. London is again an outlier, with 58% of staff reported as having ethnic minority background. And at the most senior level, 24% of the capital’s NHS finance directors are from another ethnicity.

Looking at gender and ethnicity together, 49% of the finance function is white female, 28% is white male. And of the 23% from other ethnicities, 13% are women and 10% men.

The majority of finance staff (55%) are aged between 36 and 55. However, nearly one in five is aged 56 or older. Almost one in four finance directors is 45 or younger, with a similar number aged 56 or older.

The census also reflects some of the impact of Covid-19 in the working arrangements across the country. Almost all organisations (96%) reported offering the ability to work from home (69% in 2019). NHS finance departments along with many other support services moved almost wholesale to home working at the outset of the pandemic and have retained a hybrid model in many places.

Tracking changes

Ms Knowles says the census continues to provide an important means of tracking the finance function and how it changes overtime. The function may have remained fairly stable over the years in terms of numbers, but it is now more senior than it once was. In 2009, the census reported 34% of staff at band 7 or above. This is now 43% – reflecting perhaps the growth in shared services and the move away from transactional processing and towards more value-adding activities.

‘There may be changes ahead with the increasing use of technology and the ongoing calls to reduce back-office costs,’ she says. ‘The census provides a mechanism for understanding how these developments affect the finance function as a whole – both in terms of overall size and the roles it undertakes.’

The census also holds up a mirror to the function to show where it can do better, she adds. ‘There are more women in senior roles than in previous censuses – which is a good development,’ she says. ‘But there is more to be done in this area. And that also goes for increasing the numbers from ethnic minority backgrounds who take on our most senior finance roles.’

Financial voices

For several years, the HFMA has run a finance staff attitudes survey alongside the normally biennial finance census (there has been a three-year gap since the last report to take account of the system reorganisation). Some 750 members of the finance community responded to this year’s survey – close to 5% of all finance staff. The survey provides additional detail to the comprehensive headcount provided by the census.

Almost one in three respondents has spent their whole career in NHS finance. And most seem happy with their choice of career. Asked to rate their job satisfaction on a scale of one to 10, respondents answers were towards the higher end, with a mean rating of 6.5, although this was down from 6.9 in the last survey alongside the 2019 census. Lower ratings in integrated care boards and NHS England are likely to reflect the uncertainty accompanying organisational change as clinical commissioning groups gave way to new ICBs and NHS England works through a merger and downsizing exercise.

However, there were also comments about increasing workload and insufficient capacity as adversely affecting job satisfaction.

More than half the sample (54%) saw their job as very secure, although one in four felt insecure about the medium term and 12% about the next 12 months. Again, much concern was in organisations undergoing change programmes. But 60% of respondents would like to spend the rest of their career in the NHS and most (54%) expect to do so.

Four out of five respondents believed the finance department adds value to their organisations – a small reduction on the 2019 survey. And nearly 90% believe their finance department is proactive, at least to some extent, about working with system partners. There continues to be a perception that the finance function’s contribution to the NHS and patients is not widely valued or understood.

‘Public sector values’ continue to be the most cited motivation for working in the NHS, although fewer people highlighted this than in 2019, and a wish to improve patient care is also in the top three. Participants were asked if the finance function was big enough to meet current demands. Nearly half of respondents thought it was too small, while 43% said it was about the right size. However, one in five thought it would be bigger next year, despite continuing pressure to reduce back office costs.

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This quarterly forum will give CFOs national updates and attendees can discuss pressing issues with colleagues across the healthcare system.