NHS to remove impact of pension tax for clinicians

With the busy winter period ahead, trusts are becoming increasingly concerned about the effect on patients. The issue can lead to large tax bills for employees if a pension pot exceeds an annual allowance – the allowance can be tapered down further depending on income. There are reports clinicians have refused extra sessions or promotions to avoid the bills, with some considering retirement.

The government offered solutions over the summer, proposing new flexibilities to allow clinicians to reduce their pension contributions to limit or avoid the tax. It also promised a review of the taper.

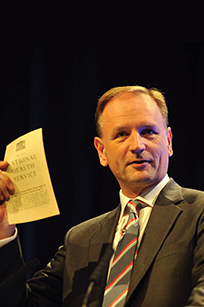

While the move was welcomed, many in the NHS said it did not go far enough. In November, NHS chief executive Simon Stevens (pictured) said there was an urgent operational requirement to act, as the flexibilities had ‘clearly not prevented large numbers of senior clinicians reducing their sessional commitments’. The election and postponement of the Budget meant that a substantive move to address the taper would be unlikely before the new financial year.

While the move was welcomed, many in the NHS said it did not go far enough. In November, NHS chief executive Simon Stevens (pictured) said there was an urgent operational requirement to act, as the flexibilities had ‘clearly not prevented large numbers of senior clinicians reducing their sessional commitments’. The election and postponement of the Budget meant that a substantive move to address the taper would be unlikely before the new financial year.

‘We have heard loud and clear from local teams and national leaders that these rules are disadvantaging staff who only want to do the right thing by patients,’ Mr Stevens said.

Clinicians who have a liability for this financial year should choose ‘scheme pays’ on their pension form – using the funds in their pension pot to pay the tax. The NHS will make a contractually binding commitment to pay the corresponding amount on retirement, ensuring they are fully compensated for the effect of reducing their pension funds. This will be nationally funded at no net cost to NHS bodies.

The new arrangements will be confined to doctors, nurses, allied health professionals and other clinicians in active clinical roles. Many organisations, including the HFMA and NHS Employers, believe changes should apply to all NHS staff.

The HFMA published the results of a snap member survey that showed more than half of respondents were considering actions to reduce or avoid pension tax bills.

Some of the 260 respondents told the association that they had already acted, such as opting out of the NHS Pension Scheme, not applying for promotion or not taking a pay rise. One respondent said they faced a £70,000 tax bill after taking an executive director of finance role.

In Scotland, from 1 December until the end of the financial year, eligible NHS staff can have their employer pension contributions paid as salary. The measure will be available to all staff who can prove they are likely to breach the annual allowance, leading to a tax charge.

The Welsh government said hospitals lost more than 2,000 outpatient, diagnostic, inpatient and day case sessions between April and August this year because of clinicians’ concerns over pension tax. Health minister Vaughan Gething said that the NHS should use local flexibilities while waiting for the outcome on proposals from Westminster.Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.