In the bank

Six months into the year and pay costs are almost inevitably a problem – more than £250m of a problem according to NHS Improvement’s quarter two report. The forecast overspend on pay has also increased significantly since quarter one. It is this pay pressure that is mainly to blame for the overall forecasts to end the year with a bigger deficit than planned. Yet NHS Improvement still sees much to be cheerful about the service’s progress to tackle its main pay problem – the cost of agency staff.

Looking at the detailed figures, the £256m overspend on pay in the year to date is driven by an overspend on bank staff of £407m. That’s not all bad news. Spending on agency staff is £78m lower than the planned level at this point in the year – a level determined by each trust’s set agency ceiling.

This positive variance of 6.1% against the planned ceiling has grown from 1.5% at Q1 and trusts are now forecasting that agency spend will come in 10% lower than the ceiling over the full year, although the bank overspend is expected to grow further.

Agency controls started to be phased in from October 2015, combining caps on rates paid to agencies with a mandatory requirement to use approved framework contracts.

‘In the 18 months since April 2016, we are now up to £1bn of reduction in agency spending,’ says Dominic Raymont, NHS Improvement’s deputy director of agency intelligence. The £319m of additional reduction this year adds to the £700m from last year, all compared with what the service would have been spending on agency staff if it had maintained its 2015/16 run rate.

‘Of the £319m cost reduction on agency, £119m is an overall reduction on temporary staff,’ he says, ‘with £200m invested back into bank.’ According to the Q2 figures, the £2.6bn spent on both bank and agency staff represents a 4.3% reduction on spending in the same period in 2016/17.

The £407m overspend on bank staff is likely to mean two things. Trusts have done better than they expected in transferring staff from agency to bank. And then they have sourced the staff required to meet increased demand and to cope with high levels of vacancies from their own banks not agencies.

The increase in demand has been significant – bed occupancy has gone up driven by a 3.4% increase in emergency admissions and increases in delayed discharges. Despite these pressures, trusts have made progress back towards the four-hour A&E target and treated more patients within 18 weeks than in the same period last year, although 18-week waits have slipped further behind the 92% target.

Coupled with the year-on-year reduction in overall temporary staff spending, NHS Improvement also says the average number of price cap overrides per trust has fallen.

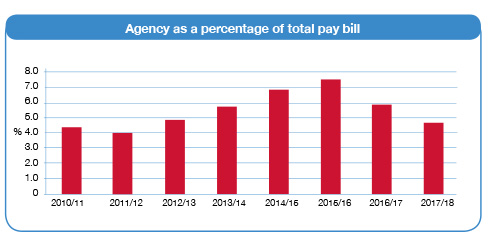

Overall agency spend is now 4.6% of the total provider pay bill. This compares with 5.8% for the full year last year and a planned level of 5%. A further fall to 4.4% is currently anticipated by the financial year-end.

Agency costs rose dramatically over the four years prior to the introduction of caps. But before then, agency costs were relatively steady at around 4% of overall pay.

Agency target

Mr Raymont thinks this is the level the service should be targeting. ‘We did some economic work at NHS Improvement to look at the efficient rate of temporary staff – looking at the different components and asking what would the minimum look like,’ he says. ‘That also came out at around 4%. Potentially with the bank work we are doing, we could get a little bit lower than that. But if we could get to that level consistently that would be good.’

There remains significant variation, with agency spend ranging from less than 1% of all pay costs to more than 18%. NHS Improvement has underlined the importance of sticking to framework contracts in all cases except where going off-framework is the only option to maintain safety. While workers from high-cost agencies may take home a higher hourly rate, agencies fees make up a larger proportion of the total cost.

In one example of a band 5 worker, fees might account for 25% of the capped £22.85 per hour rate. But with a high cost agency, more than 40% of the higher rate (£51.95/hour in one example) could be going to the agency. And while the presumption would be that off-framework usage is a last minute emergency practice, through its ongoing data collection NHS Improvement can now see that in one week in June, 66 band 5 nursing shifts had been booked more than 32 days before the shift.

In total, the cost of all band 5 nursing shifts booked with high-cost agencies more than seven days in advance that week was £166,669. Mr Raymont says that most of these costs could be avoided by more efficient booking of shifts.

He adds that the make-up of savings has changed a little since last year. About 42% or £300m of the £700m savings last year came from medical staffing – a mix of price reductions and volume reductions. This year, medical staff account for about a third of savings to date, with nursing staying consistently at 24% and admin and estates staff accounting for the biggest proportion.

Mr Raymont says this is to be expected as last year will have included some initial big savings simply by applying the agency rules and adhering to frameworks. He admits that there was also probably a non-recurrent reduction in medical locum spending at the start of the year as some clinicians registered a protest to the IR35 rule change – meaning more medical locums have tax deducted at source rather than it being dealt with through intermediary companies.

However, he believes the IR35 change has not had any lasting impact. ‘We’ve seen a return to a more normal trend, the locums have in the main come back and the supply issue appears to be no worse than before,’ he says. ‘There is still an undersupply of doctors in certain specialties, but that is not because of IR35.’

Locum action

NHS Improvement is working with the 30 trusts with the highest locum spend last year to help them meet their locum reduction ceilings. Twelve of these are on track with seven others within £0.5m of their trajectory. Of the 11 off trajectory, five are moving in the right direction while six are not improving. And on the under supply of doctors generally, the organisation is working with a number of trusts on overseas recruitment.

Across all disciplines, says Mr Raymont, trusts have been getting to grips with long-serving temporary staff, as submitted data highlights the issue. ‘In some cases people have been with organisations for several years – they clearly like working there,’ he says. ‘[Making it visible] has helped trusts to have conversations with these people about what could be done to enable them to move across to payroll.’

Another example revealed a temporary finance manager at the same trust for five years. Mr Raymont questions whether this could be justified on higher agency rates. ‘If they have a requirement for not working school holidays or working part-time, this can be accommodated in a full-time contract or at least we could move them onto the bank as a stepping stone to that.’

He is aware that the weekly data submissions are a burden on providers, but insists the intelligence is helping. ‘We are constantly reviewing what we need,’ he says. ‘We no longer collect the maximum wage rate for example – we stopped this when we started collecting the bank information. We use NHS Providers as a sounding board for data changes and are advised by a senior stakeholder group.’

Some software providers are starting to build functionality into systems to facilitate simple reporting of the regulator’s requirements.

NHS Improvement’s major focus this year has been around staff banks, which it sees as the key to making cost shifts permanent. It wants to do three things:

- Improve use of existing banks

- Improve reach (for example, encouraging medical banks where they don’t yet exist)

- Encourage collaboration.

A toolkit was due to be launched at the beginning of this month to support its first target. This will include case studies, checklists and suggestions of how to improve the running and use of banks.

Some of the tips are simple – for example, engaging with the temporary workforce. Others are more practical – letting staff interact via a smart phone app, ensuring there are options for weekly pay, reducing the lead time to get someone approved for bank work and ensuring the process for requesting staff builds in an opportunity to challenge the requirement.

‘On the technology side, agencies do this well. Doctors are very tech savvy and they prefer to book shifts using their phone,’ says Mr Raymont. With a market emerging in these sorts of technology solutions, NHS Improvement plans to help trusts evaluate and select the ones that will work best for them.

A summer survey found that just three quarters of trusts with a staff bank of some sort had a medical bank. And some of these were not really transacting business. So as part of its work to improve reach, NHS Improvement is targeting to increase this proportion to 90% by this month, as well as increase the number of temporary shifts filled by bank staff.

On the collaboration side, it says there are already collaborative banks in operation or under development in 30 out of the 44 sustainability and transformation plan areas. A hub and spoke model – where a trust cascades shifts out to bank workers of other trusts – is the most common model to date, but it wants full coverage over the coming months

The big challenge for the NHS for the remainder of the year – operationally and financially – will be the winter. A bad winter leading to increased demand could provide significant challenges in meeting existing financial forecasts overall and for agency and bank spending.

That would be disappointing, as Mr Raymont feels the moves are all in the right direction on temporary staff. Next year, as the bank work takes hold, he believes the service could start to see a permanent shift away from agency and into bank. However, he says the centre will continue to stay interested and keep pushing for improvement. ‘If we stop pushing before this permanent shift happens, we could slip backwards,’ he says. ‘We need to get the banks properly established and temporary staff used to working through them.

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.