Feature / Continued pressure

Relationships with sustainability and transformation partnerships are strengthening, according to NHS finance directors. But there are still significant concerns that sustainability and transformation plans can help close the funding gap by 2020/21.

Relationships with sustainability and transformation partnerships are strengthening, according to NHS finance directors. But there are still significant concerns that sustainability and transformation plans can help close the funding gap by 2020/21.

STPs – an acronym that now appears to stand for both the 44 system-wide plans and the partnerships delivering them – are crucial to delivering new models of care at the heart of the Five-year forward view. And finance leaders have previously backed STPs as a good way to find system solutions to the challenges of rising demand, an ageing population and greater prevalence of long-term conditions.

With plans completed by the end of 2016, the focus is now on implementation. And the relationships between different stakeholders in each local partnership will be key to success.

When the HFMA asked trust finance directors and commissioner chief finance officers about STP relationships in December, only 20% thought they were strong enough to deliver change. This did not appear to be a major vote of confidence in the transformation programme. So it is encouraging to see this figure rise to a more reassuring 50% in a survey undertaken as part of the HFMA’s latest NHS financial temperature check, published at the beginning of July.

Within this improving picture, there remain pockets of concern – more work is needed to strengthen ties with the voluntary and ambulance sectors, for example. And trusts in particular feel general practice links should also be improved.

But while these core relationships are starting to gel, what they are trying to achieve – or at least the timescale that it needs to be achieved in – looks just as daunting.

STPs are expected to play a major part in the transformation of care services that will help the NHS close an estimated £22bn funding gap by 2020/21. But the Temperature check finds that 89% of trust finance directors and 77% of clinical commissioning group CFOs are either not confident or not very confident that STPs can deliver the plans to close this funding gap.

Most finance directors said their operational plans are aligned with STP plans but only half of trust and CCG finance directors believe their actual contracts are aligned to STP plans. Some went as far as to say that contracts

‘bear little resemblance’ to agreed plans.

The Temperature check concludes that moving from planning to delivery at the STP level might require ‘significant effort if competing organisational priorities are not to get in the way’.

Capital concerns

Capital – or the lack of it – is a major obstacle. Just 1% of trust finance directors and 3% of CCG CFOs think there is enough capital to support STP transformation programmes. (The survey predates the Conservative party’s pre-election response to the Naylor review and its promise of the ‘most ambitious programme of investment in buildings and technology the NHS has ever seen’.)

Concerns also remain about governance arrangements for STPs, although respondents recognised that STPs are still at an early stage.

Finance directors’ views need to be seen in the context of the extreme financial challenge being faced by the whole service. The Q4 report from NHS Improvement showed providers ended the year with a £791m deficit after receiving £1.8bn from the Sustainability and Transformation Fund. Month 11 forecasts for CCGs – the latest figures published – suggested a £550m overspend, although this was before the release of an £800m risk reserve.

Providers’ deficit compared with a planned deficit of £580m and the CCG risk reserve was intended to provide a balancing mechanism for system-wide imbalance. But the risk reserve was primarily seen as a means to offset provider deficits rather than commissioners’ own overspends. Despite providers and commissioners reporting an aggregate worse-than-plan position, 63% of CCGs and 84% of trusts said they performed the same or better than planned at the start of 2016/17 – a reversal of 2015/16, perhaps indicating a shift of pressure from providers to commissioners.

Agency staff costs remain a major challenge, with two thirds of providers identifying this as a major negative variance against plan. This is consistent with NHS Improvement figures, which show a £700m year-on-year reduction in agency spending – recognised as a ‘huge achievement’ – but with providers still spending £559m more than plan and only 46 providers meeting their agency ceilings. A more general underachievement against savings plans was identified by 58% of trusts, with delayed transfers of care another major overspend.

For CCGs, the main overspends were related to underachievement of savings and over-performance on acute contracts.

Some 44% of trusts (105 of 238) ended 2016/17 in deficit. The Temperature check suggests a similar position in 2017/18, with 45% predicting a deficit, though 34% of trusts expect to post a deficit in 2018/19. The acute sector continues to face the most pressing financial challenges, with 82% of acute providers predicting a deficit this year.

CCGs predict an improving position over 2017/18 and 2018/19. But both commissioners and providers stress that there are lots of risks attached to the achievement of plans. Some 94% of CCG and 95% of trust finance directors said there was a medium or high risk that they wouldn’t achieve their financial plans.

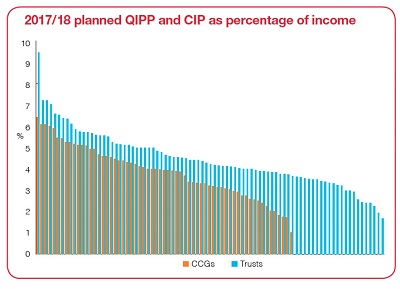

Finance directors tend to be cautious – some might say pessimistic – by professional nature, but their concerns seem well founded. Trusts on average are targeting a 4.5% cost improvement as a percentage of income, while CCG plans are based on 3.9% QIPP savings.

Trusts average saving target outstrips the 3.7% cost improvement (as a proportion of expenditure) reported by NHS Improvement for 2016/17. After month 11, NHS England was forecasting QIPPs of 2.6% against a plan of 3.2%. NHS England chief financial officer Paul Baumann described last year’s QIPP target (itself a step up from 2.2% in 2015/16) as ‘the highest ever level of QIPP efficiencies’. The 3.9% plan suggested by the Temperature check is clearly a significant further step up.

Trusts’ failure to achieve CIP targets would put both achievement of control totals at risk and, as a consequence, access to the £1.8bn STF money. Some finance directors who had signed up to control totals said they had also flagged up the risks around achieving their required CIP to NHS Improvement. A quarter of those in the survey who had signed up to control totals said they did not expect to meet all the conditions, which cover finance, agency spend and access, in 2017/18. This percentage increases for 2018/19.

Trusts are planning to deliver 82% of savings recurrently in 2017/18 – a step up from the 71% achieved in 2016/17. CCGs are planning a similar level of recurrent savings this year (73%) as last year. But more than half of finance directors said they were not very or not at all confident that their recurrent savings plan could be delivered. Confidence levels were much higher for non-recurrent plans.

Reducing unwarranted clinical variation, removing services with limited clinical value and redesigning acute pathways were each highlighted by more than 80% of CCGs as key ways of meeting QIPP plans. Integration was also flagged up by three quarters of CCGs.

Trusts remain focused on agency staff costs, procurement savings and estates rationalisation as the main tools for improving efficiency. They also flagged up concerns that Brexit could add pressure on recruitment and retention.

Productivity progress

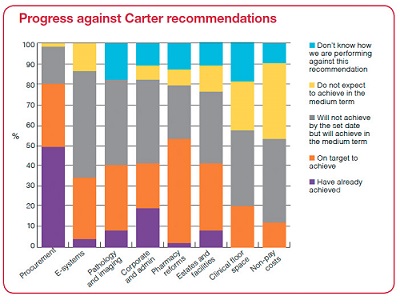

The Temperature check questioned finance directors on progress delivering the savings identified by the Carter review of productivity in acute trusts. The review suggested £5bn of savings could be achieved by 2020/21 from measures in pharmacy, pathology, procurement, estates and corporate costs.

Over 50% of trust respondents said they expect to meet the Carter recommendations to reduce unwarranted variation in operational productivity in all areas in the medium term. Most progress has been made against the recommendation to report productivity information monthly to NHS Improvement. Nearly half have already achieved this.

Only 8% of respondents have achieved the recommendations to achieve agreed benchmarks in pathology, imaging and estates (targeted for April this year). However, finance directors were confident of achieving these in the medium term. The least developed areas are in non-pay costs and clinical floor space.

On corporate costs, Carter urged providers to ensure corporate and administration costs did not exceed 7% of income by April 2018 and 6% by 2020. Nearly all reported that they are considering consolidation options, such as shared services, outsourcing and collaboration with other organisations.

Mark Orchard, HFMA president, described recent years as ‘the most financially challenging that most of us in the NHS can remember’ with challenges set to continue. ‘However, there are reasons to be positive. The level of efficiency savings delivered in 2016/17 by finance staff working with their clinical and management colleagues should be applauded,’ he said.

‘In many ways, though, this is just the beginning,’ he added. ‘The efficiency challenge in 2017/18 is even tougher. Collectively, everyone in the NHS needs to find ways to be more resourceful, more innovative and more collaborative to address the financial challenge in front of us.’

The Temperature check provides a useful snapshot of the current financial challenge. Finance directors are clear that 2017/18 looks set to be the most difficult year yet in a run of difficult years. There is clear evidence that finance directors see potential for improvement and greater efficiency through greater integration, implementation of the Carter review, rollout of the RightCare programme and use of new care models.

But the report concludes that ‘there is no single panacea and significant uncertainty

that in aggregate these approaches will be able to achieve what they need to if they are to restore the system to financial balance’.

It highlights the high levels of risk associated with ambitious 2017/18 savings plans and underlines that ‘the financial challenges are set to continue’.

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.