Understanding the implications of a debt for equity swap for NHS providers

There has been a lot of talk recently about the possibility that the Department of Health and Social Care will replace provider revenue support loans with public dividend capital (PDC) – which is the equivalent of a debt for equity swap in the commercial world.

So what might this mean for the 117 provider bodies that have current or non-current revenue support loans as at 31 March 2019?

First, it may well reduce some of the administrative burden that comes with applying for revenue support loans to manage working capital. In most cases, these loans can only be repaid when another loan is received, so that there is a constant application and re-application process taking place.

First, it may well reduce some of the administrative burden that comes with applying for revenue support loans to manage working capital. In most cases, these loans can only be repaid when another loan is received, so that there is a constant application and re-application process taking place.

Second, it will have an impact on the revenue costs resulting from borrowing. Loans issued by the Department currently attract interest of either 1.5% if providers are delivering control totals or 3.5% if not. There was also a 6% rate, but this is no longer being issued.

On the face of it, because provider bodies have to pay a 3.5% PDC dividend to the Department each year, this looks like a bad deal for those provider bodies borrowing at 1.5%.

However, this may not necessarily be the case. The calculation of the PDC dividend is not a straightforward 3.5% of PDC. Instead, it is 3.5% of the average relevant net assets of the provider body and any of its subsidiaries for the year.

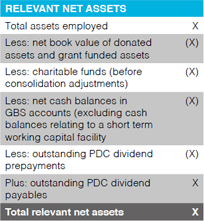

The definition of relevant net assets, according to the 2019/20 Group accounting manual, is shown in the table.

To calculate the average, the opening balances are added to the closing balances and then the total is divided by two.

The complicating factor is that the calculation of the net cash balances in Government Banking Service accounts is on the basis of the average daily cleared balances. It is therefore impossible to calculate the impact of the debt for equity swap without detailed information about daily cash balances.

Based on our calculations using the 2018/19 provider accounts information, 30 provider bodies had negative net assets at the end of March 2019. None of these entities paid a PDC dividend in 2018/19.

If their current and non-current revenue support loans are all turned into PDC and effectively move from liabilities in the top half of the balance sheet to taxpayers’ equity in the bottom half, only two bodies would still have negative net assets at the end of March 2019.

On the face of it, the other 28 bodies would pay a PDC dividend. However, in 2018/19, those 30 bodies paid £78,404 of interest on revenue support, so that would no longer be paid.

In terms of accounting, section 3.3 of the international financial reporting standard on financial instruments (IFRS 9) requires financial liabilities to be removed from the statement of financial position when, and only when, they are extinguished. This means the obligation is discharged or cancelled or expires.

In the case of revenue support loans, the Department will have to cancel the obligation to repay or issue PDC to the same value that can be used to discharge the liability.

In the case of revenue support loans, the Department will have to cancel the obligation to repay or issue PDC to the same value that can be used to discharge the liability.

IFRS 9 says that the difference between the carrying amount of the financial liability extinguished and the consideration paid should be recognised in the statement of comprehensive income. It is unlikely that there will be any difference in the case of these loans.

As a final thought, it will be interesting to see what impact this transaction, if it happens, will have on the going concern assessments of NHS provider bodies.

• Debbie Paterson is HFMA policy and technical manager

Related content

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.

This webinar series offers colleagues of ICS organisations the opportunity to discuss common priorities, challenges, and successes within their field.