Treasury proposes full refund model as preferred option for VAT simplification

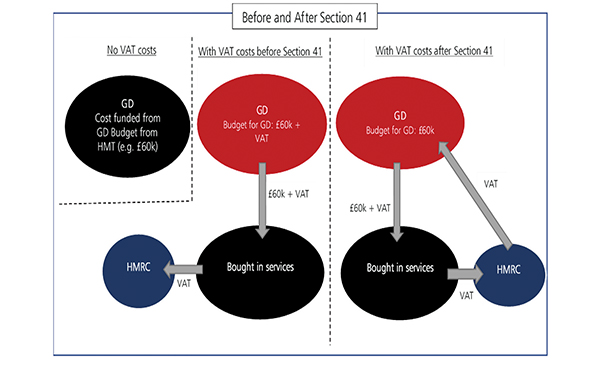

Currently, only VAT incurred on services on the list of contracted-out services (COS) headings can be recovered by bodies subject to s41. The proposed full refund model will extend the scope of s41 to permit full refunds of VAT incurred on all goods and services purchased during the course of non-business activities.

It is intended that this proposal will remove barriers to working with central government and NHS bodies for businesses, charities and local authorities and, therefore, reduce the risk of entering into new working arrangements.

The simplified arrangements should also reduce the need for advice from external consultants and/or HMRC.

It is hoped this will result in speedier business case and budget development for new ways of working. And the focus of proposals should be on service delivery rather than the VAT implications of the new working arrangements.

Simplification should also reduce the number of queries raised and errors made when invoices are processed – reducing the resource currently employed by management and HMRC to answer queries and identify and correct errors.

The government has made it clear that any proposed changes must be fiscally neutral, so these proposals will affect allocations voted to government departments. Currently, departmental expenditure limits (DELs) include funding for VAT that cannot be recovered.

However, recoverable VAT is processed through annually managed expenditure (AME). These proposals will automatically affect AME as they relate to recoverable VAT so an equal and opposite adjustment will have to be made to DEL budgets to ensure the proposal will be fiscally neutral. Adjustments to DEL will have a knock-on effect on the Barnett formula for the devolved nations, so their views are sought on this specific issue.

The data to assess the impact of the proposals on budgets is not readily available so the Treasury has started to gather the data necessary to establish the scale of any budget adjustments. There will be further information on this collection process in due course. NHS bodies will recall that there was a data collection following the March 2019 announcement – there are likely to be further such requests although the paper is clear that no changes will be implemented until the ongoing Covid-19 crisis eases.

The policy paper is not a consultation document, but the Treasury is asking for views on it by 19 November. There are no specific consultation questions as the government is interested in any reactions or comments from interested stakeholders. This could include NHS bodies and their subsidiaries, those who work with NHS bodies, suppliers of goods and services and suppliers of VAT and tax advice.

Debbie Paterson is HFMA policy and technical manager

Taking soundings

The proposal document specifically seeks views relating to:

- The proposed full refund model or any alternative models

- The complexity of implementing the reforms

- The nature and scale of the administrative burden of the current COS arrangements for public sector bodies

- The impact of the current s41 rules on businesses interacting with central government and NHS bodies and the merits of the proposed reform

- Whether the proposed reform provides benefits to productivity and organisational structuring

- Whether the current system requires legal

and tax professional resource to resolve disputes and whether that resource will not be required under the proposed simplified system - The impact the proposal could have on ensuring that the UK is an attractive place for business and enterprise

- The appropriate timing, methodology and associated costs for implementation – particularly the impact on accounting systems and contracts with external service providers.

Related content

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.

This webinar series offers colleagues of ICS organisations the opportunity to discuss common priorities, challenges, and successes within their field.