Feature / Telling the finance story

Financial information is crucial for boards to be able to take decisions to steer their organisations. But what level of detail should be included and how should it be presented? Answering these questions and more was the challenge taken on earlier this year by an HFMA roundtable.

Financial information is vital to enable boards to take decisions based on value – taking account of quality and outcomes alongside the resources consumed.

It not only has to be correct, it also has to be presented in an accessible way that enables executives and non-executives to understand the key numbers. And importantly, it has to be put into context. What are the key numbers that boards should look at? And what does it mean if those numbers change?

The roundtable was supported by NHS Shared Business Services, which produces the financial data for inclusion in the board reports of all clinical commissioning groups and a number of provider bodies – and will provide its finance and accounting service to the new integrated care systems from next April.

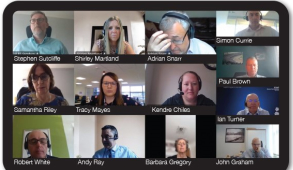

The roundtable brought together finance directors and chief finance officers from providers and commissioning bodies with those tasked with producing their own organisation’s monthly board reports, as well as non-executives, representatives from NHS England and NHS Improvement and the National Audit Office (NAO).

Perhaps the first question that needs to be answered is: who is the audience for financial reports? There are a wide range of interested parties as well as the obvious board members, including regulators, patients, staff, the wider system (more of which later) and the press.

If being addressed directly, all these different audiences might prefer to see the information presented in a slightly different way. However, attendees were clear that the focus had to be on meeting the needs of board members.

‘The main audience has to be the unified board, so that it can take assurance from what is being presented to it and understand if the organisation is achieving what it is required to achieve,’ said Barbara Gregory, former finance director and currently a non-executive director of Somerset NHS Foundation Trust. ‘The meetings are not public meetings after all, but meetings in public.’

Reports vary across the NHS in terms of the detail provided. Shirley Martland, associate director of financial services and payroll at Wrightington, Wigan and Leigh Teaching Hospitals NHS Foundation Trust, said too much information risked ‘information overload, with readers switching off and becoming overwhelmed.’

But while excessive detail could mask the few key issues on which the board should be focused, short reports can simply not provide enough depth of information to understand what is going on.

Simon Currie, director of financial planning and delivery at NHS England and NHS Improvement, said there was a challenge in reconciling competing requirements.

‘Whatever is written in board papers needs to be brief, but you need to put enough in so readers can actively challenge it,’ he said. He suggested there should be a short standard board report each month with a rolling programme of deeper dives into other areas.

However, the board only formed part of the scrutiny process, he added. ‘Part of the challenge process happens in board sub-committee meetings, such as the audit or finance committee, where you can present a greater level of detail to the finance specialists.’

Keep it simple

Language is clearly vital. Ian Turner, HFMA director of finance and a non-executive director at Devon Partnership NHS Trust, said clarity and simplicity were the watchwords.

‘Finance has an additional challenge to other parts of the NHS in terms of communication with NEDs,’ he said. ‘They have to get their heads around the language of the NHS and that can take years.

‘But on top of that, some NEDs won’t understand the language of finance. So, it is about keeping it simple and using all the tools at our disposal – such as graphs, pie charts and tables.’

Across the NHS there are terms that are used often but which have different meanings in different organisations. Terms are even used to mean different things in different contexts by the same organisation. Run rate is an example of an ambiguous term that has been highlighted before.

So, terms need to be crystal clear and well defined. Again, complete clarity is needed when describing financial performance – are the under- or overspends compared with plan or an absolute position?

CCGs report their drawdown of historic surpluses in different ways, making comparisons across organisations difficult. Even presentational conventions such as the use of brackets for negative amounts would benefit from standardisation across the service.

Ms Gregory said that, with her non-executive hat on, what she likes to see are ‘short explanatory sentences interspersed with small tables that pick out headlines and key messages’. Too much text can be impenetrable, and pages of tables fail to highlight the key numbers that the board should be looking at.

By providing too much detail, the danger is that nothing gets looked at – especially in the context of wider board papers often taking on telephone directory-like proportions.

Ms Gregory said she would also like to see more information about the costs of services, with the change in payment regime moving the focus away from income.

‘We are pushing now to have more visibility of how divisions within the organisation are actually doing,’ she said. ‘It is difficult to turn them into profit centres in the current environment, but we are beginning to look at them again as cost centres and ask how we can get assurance that they are working effectively.’

Focus on variation

Sam Riley (pictured), deputy director of intensive support at NHS England and NHS Improvement, argued for the inclusion of graphs. She said statistical process control (SPC) offered a better way for NHS bodies to analyse and present data, compared with traditional RAG (red, amber, green) rating approaches.

SPC looks at data over time and recognises natural variation so that those monitoring performance can focus on the variations that really merit investigation. This, she suggested, is what boards need – something that helps them to quickly identify the issues that must be addressed and where decisions should be taken, and to avoid overreacting to random data changes.

Born in the manufacturing industry, the technique is increasingly being applied in healthcare and Ms Riley, who leads the NHS Making data count initiative, believes it has a role in helping boards to understand if their organisations are making the most effective use of resources.

‘Early work in trusts around finance using SPC is helping to start to answer that question,’ she said. The Shrewsbury and Telford Hospital NHS Trust was applying SPC to finance and workforce datasets, helping them to see things they would previously have been unsighted on. ‘For example, they were able to see that they were providing lots of agency cover for junior shifts, which is something you wouldn’t want to be seeing,’ she said.

Similarly, Maidstone and Tunbridge Wells NHS Trust had started using the approach to look at nursing spend per occupied bed day over time.

Numbers needed to be provided with context, said Stephen Sutcliffe, director of finance and accounting of NHS Shared Business Services. So don’t just report what the number is, but explain the implications.

‘The “so what” is vital,’ he said. ‘Reporting a reduction in cash held on the balance sheet could mean that you are not paying small and medium-sized enterprises (SMEs), for example,’ he said. The consequences of the numbers should be explained, he said, adding that timeliness of reporting was also important. ‘We have clients who report on day one and clients who report on day 12. I see no reason for such variation.’

Connected thinking

Ms Martland said one of the problems with board finance reports was that they tended to report everything in isolation – particularly treating income and expenditure separately from the balance sheet and capital.

‘If we are telling the story, the reader needs to understand everything that is happening across the organisation,’ she said. ‘For instance, we might report that we are not achieving cost improvement programme (CIP) targets, but provide no indication of how that will impact on cash in the future months and lead to a decline in our cash position.’

Kendre Chiles, assistant finance director, financial services, at University Hospitals of Derby and Burton NHS Foundation Trust, is responsible for preparing the balance sheet and cash paper for the trust’s finance and investment committee. She said there is a significant focus by the committee on the income and expenditure position, which wasn’t wrong given its importance in providing key financial information on trust operations.

So, with less attention given to the balance sheet and cash, her challenge was to present the key information in as concise, engaging and understandable way as possible.

‘It is important it gets the airtime,’ she said. ‘The integrity of the balance sheet is an indicator of the robustness of the income and expenditure position presented.’

The balance sheet could be the ‘canary in the coalmine’ for where there are emerging financial challenges for an organisation, Ms Chiles added.

Her short – five or six page – report includes a condensed, summary balance sheet and cash flow report at the front and a cash table showing cash by month.

‘If you are a challenged organisation, the key isn’t the cash balance but whether you are drawing down the support you thought you would,’ she said. ‘If you’ve hit your plan on cash every month, but you are drawing down twice as much cash to achieve that, there is an underlying problem. That is what I want board members to focus on and question.’

The trust has recently introduced trend analysis to the report, showing how invoiced debt and accrued debt and invoiced cost and accrued cost are moving.

‘That has allowed the NEDs to question whether these metrics are going up or down and what is driving that,’ she said.

In the balance

The roundtable debated the importance of the balance sheet in the NHS and whether it should be subject to more scrutiny. NHS England and NHS Improvement have overseen a re-engineering of balance sheets across the service over the past year or so, shifting more cash into the provider sector. And their director of financial control, Adrian Snarr, said that the centre was likely to take a greater interest in future in how providers were using their improved cash position.

He highlighted the NHS’s poor reputation for paying suppliers on time – behaviour that developed when providers’ cash resources were low. Last year, the Cabinet Office issued guidance encouraging early payment of critical suppliers during Covid to keep cash flowing in the economy and protect against unnecessary supplier failure during the pandemic.

Mr Snarr (pictured) said this should also be a key focus for boards – and not just because of Covid, but as a way of supporting local economic recovery. ‘We should be promoting use of SMEs in local health systems,’ he said. ‘And the best thing NHS bodies could do is pay them on time or pay them early.’

The centre will be keeping a closer eye on this in future, both for recovery purposes and because it needed a good understanding of cash flows for discussions with the Treasury.

The national bodies are in discussion with NHS SBS about how they can track cash better and encourage organisations to pay on a more timely basis.

In terms of balance sheet reporting more generally, roundtable chair Andy Ray – chief financial officer of Mid and South Essex joint commissioning team and chair of the HFMA Accounting and Standards Committee – said he championed old-fashioned metrics, such as the percentage of invoices paid on time and current ratios, as providing a truer indication of organisation financial health.

‘Normally, one of the first red flags of an organisation in trouble is that it stops paying suppliers on time,’ he said. ‘It often indicates an underlying problem. Including the payment percentage in board reports, along with the movements over time, should raise questions.’

He suggested that a cash dashboard, such as the one developed at Barking, Havering and Redbridge University Hospitals NHS Trust – an idea from stress-testing banks – provided an opportunity to flag up warning signs to non-finance leaders. ‘It is hard to hide things on the balance sheet,’ said Mr Ray. ‘If you are accruing income that isn’t real, you end up with aged debtors and creditors.’

Spotting problems

While he acknowledged that some recent cases of financial problems at NHS providers had not been spotted by boards, auditors or the regulator, problems may have been found if different metrics were being looked at.

However, he acknowledged that board members should be provided with easily understandable reports and trained in what to look out for.

Mr Currie said NHS England and NHS Improvement had regularly looked back at financial problems in organisations to understand if they had missed early warning signs. But so far, he had not identified in the data reported anything that would have highlighted the issue. As a result, he said, the centre was exploring increased scrutiny of submitted reports – and in particular using the balance sheet and cash to spot income and expenditure problems. He added that there was a role for NEDs in providing appropriate scrutiny.

The way that the NHS is performance managed on a strict annual basis – with no real opportunity to deliver goals over a longer term also gave board reports an overly annual focus, according to John Graham, finance director at Stockport NHS Foundation Trust. They tended to be about how the organisation was doing this year, not how it was doing against its long-term goals.

Responding to the concerns about the late emergence of issues, Mr Graham asked: ‘How much has the management of control totals at organisation level and system level played into this? We are managed on performance at 31 March and the system congratulates itself on achieving a year-end position and then we move on to the next year.’

Board reports should be focused more on the underlying position and not the simple year-end snapshot.

Mr Snarr pointed out other red flags boards should look out for, in particular the auditor’s ISA 260 reports. ‘There is information out there from auditors and there’s a risk that organisations are quite dismissive of this,’ he said.

They sometimes disregard the findings, blaming the auditor for ‘being picky’ or ‘risk averse’. ‘But actually, there are often early warning signs in those external audit reports, and boards should be encouraged to embrace them and challenge the auditor or the finance director appropriately.’

Ms Gregory said the response to highlighted issues was key. If an organisation chose to treat the issue as a risk rather than a problem, it might still lead to no action being taken. The SPC approach might help to distinguish issues that need to be treated more seriously because of a poor trend over time.

But it was important for the finance board paper to be locked into the board assurance framework and for the paper to address the objectives and risks in the framework.

The key, according to the NAO’s Robert White, was to ensure that NEDs had the right indicators in place to tell them if things were going off track and that they knew how to interpret the indicators. However, he also wondered if enough research had been done to look at the non-financial indicators that drive financial performance. He accepted it was not easy to make linkages – for example, between length of stay, utilisation or capacity and financial performance – but, given some of the problems with getting timely financial data, he asked: ‘What indicators could we monitor that the money follows?’

Mr Graham agreed it was possible to get an idea of what was coming financially by tracking the big financial drivers. ‘At Stockport, we look to collect information on a weekly basis around any movements in use of bank or agency staff,’ he said. ‘And on non-pay and some drivers around theatres and orthopaedic specialties, we look to see what’s been on the order book, what activities have been delivered and whether that’s affected our use of stocks. So there are things you can use that give an indication of what may happen when you get the formal reports.’

System thinking

The roundtable also discussed the implications for financial reporting of the move to integrated care systems (ICSs). ‘Most of our conversations have been about organisations,’ said Paul Brown, chief finance officer of Staffordshire and Stoke Clinical Commissioning Groups. ‘But the future is about systems, and financial reporting for systems will need to be quite different. It is about reporting on the costs across the whole patient pathway – that’s what boards need to be focused on. And we can only do that properly if we look across the whole pathway, including the thorny issue of what is spent in social care.’

He added that the move to systems would also require organisations to change their own board reports. ‘To make reports meaningful to our organisations, we have to not only talk about the organisation, but about how that organisation fits alongside others in the system and how collectively we are managing the cost of patient care and maximising the clinical output and quality,’ he said. ‘That is quite a different way of looking at it.’

Tracy Mayes, deputy chief financial officer (finance, contracts and procurement) at East Riding of Yorkshire Clinical Commissioning Group, said ICSs would have a responsibility to look at provider board reports. ‘That gives a new lens on provider board reporting,’ she said. ‘They could have risks in there that could take the system down, so the board report comes into a new level of focus for everybody.’

In terms of board report audiences, she said this felt different to having a collection of a single organisation’s executives and NEDs sitting around the table.

There has been much talk about the importance of collaboration in system working. But the simple act of board reporting would demand a different culture around transparency and open book accounting, which may counter some of the behaviours developed during the payment by results era.

Pathway focus

Ms Mayes agreed that systems would need to focus on whole patient pathways and underlined that addressing health inequalities would be a major priority for the new ICSs. To do this, boards would need to understand how resources were being spent at system, place and neighbourhood level, which would place new demands on financial board reporting.

There will be technical challenges too. NHS England and NHS Improvement to date have done little more than consolidate bottom lines of organisations in systems to get a system level finance view. ‘But we are starting to look at how we properly aggregate those numbers,’ said Mr Currie, ‘and eliminate the trading balances between commissioners and providers to try to give a proper close-to-consolidated view of where money is being spent, taking into account inflows and outflows.’

Being able to identify the actual money being spent in the system would be vital if systems were going to explore changes around allocative efficiency, he said. But he acknowledged that the centre did not want to create an approach that was so complicated it added a week to the reporting timeline. ‘It needs to be slick,’ he said, ‘while doing more than just adding the bottom lines, which will only give rudimentary information.’

Mr Snarr added that simply adding cash balances together doesn’t work. ‘CCGs draw cash in and providers hold cash until it is spent – that read across doesn’t tell us anything meaningful as a metric,’ he said. ‘So we need to understand what the value-add indicators are at a system level.’

The complexity of the NHS provided other challenges, he said. Some organisations had established subsidiaries and were providers of shared services in a major way, bringing cash into the system. ‘Should you disaggregate that from the ICS or not?’ he asked. ‘I don’t think you can.’ He added that specialist trusts providing services for patients from across the whole country provided further complications in establishing meaningful financial numbers about what is being spent within systems.

Mr Brown agreed about establishing a proper understanding of what was being spent and where. In Staffordshire, about 50% of acute activity flows are outside its system. So while system-level finance reporting will be important, patient flow reporting that was system agnostic would also be needed.

Ms Chiles said developing a meaningful financial picture across the system would be challenging. ‘Every organisation holds its information in its own way, on its own platform and in its own chart of accounts,’ she said. ‘So there is a real risk that we compare apples with pears and the information that comes out won’t support robust decision-making.’ She added that the Derby system had made some progress with capital following a need to create regional capital envelopes.

As provider of the Integrated Single Financial Environment (ISFE), NHS SBS has a good view of consolidation challenges, delivering a single financial platform for commissioners in England. ‘The ability for NHS England and NHS Improvement to report on every single CCG today, and in future every ICS, at the push of a button is one of the key benefits for ISFE,’ said SBS’s Mr Sutcliffe. But discussions with providers and systems had reinforced the idea that consolidation across all organisations in a system is a key concern.

Mr Sutcliffe believes technology could provide the solution. ‘Looking at technology into the future, it is moving really quickly and can enable consolidation in a different way without needing organisations to be on the same finance platform,’ he said. He added that NHS SBS was looking at various solutions.

In conclusion the roundtable highlighted the importance of clarity. Language and easy to understand tables and graphics were essential. Reports needed to get the right balance between giving only the essential information to provide boards with the assurance that objectives were being met and risks managed, while providing enough detail to enable proper understanding and challenge. And context is crucial – not just presenting the number, but explaining why it is important and the implications of movements.

New ways of presenting data and changes over time – such as statistical process control – provided opportunities to help boards hone in on variations that are outside the normal range and need addressing. However, the move to system working will place new demands on financial reports to boards, presenting technical challenges such as meaningful consolidation, and a new focus on pathway costs and health inequalities.

Participants

- Paul Brown, Staffs and Stoke CCGs

- Kendre Chiles, University Hospitals of Derby and Burton NHS FT

- Simon Currie/Samantha Riley/Adrian Snarr, NHS England and NHS Improvement

- John Graham, Stockport NHS FT

- Barbara Gregory, Somerset NHS FT

- Shirley Martland, Wrightington, Wigan and Leigh Teaching Hospitals NHS FT

- Tracy Mayes, NHS East Riding of Yorkshire CCG

- Andy Ray (chair), Mid and South Essex Joint Commissioning Team/ HFMA Accounting and Standards Committee

- Stephen Sutcliffe, NHS Shared Business Services

- Ian Turner, Devon Partnership NHST

- Robert White, National Audit Office

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.