Feature / Keeping up the pressure

NHS providers have turned a corner on agency spending in 2016/17, reversing the trend in recent years for year-on-year growth. But agency spending still remains at unsustainable levels and providers will need to intensify their efforts to reduce costs even further.

A letter from NHS Improvement chief executive Jim Mackey to provider chief executives in July set out the extent of the improvement. ‘Total agency spend reduced in 2016/17 by £700m compared with 2015/16 and represented 5.8% of total NHS pay bill as opposed to 7.4% the previous year,’ the letter said.

This reduction follows sustained growth over the previous four years, before which spending had been a more manageable 4% of total pay. In July 2015, monthly spending reached more than double this historical level when it hit 8.2% of total pay.

In terms of absolute numbers,

agency spending fell from £3.6bn in 2015/16 to just over £2.9bn in 2016/17. Dominic Raymont (pictured) NHS Improvement’s deputy director of agency intelligence, says trusts have done a ‘cracking job’. While a series of centrally introduced controls has provided the framework for these reductions, he says the credit is with the local providers that have implemented key changes in process.

But he is also clear that the job is only half done. ‘If we don’t continue the effort, spend could easily go up again. We need to keep paying attention to this issue, recognising that 5.8% is still really high and unsustainable,’ he says.

A further reduction of £500m is being targeted this year, which if successful would bring agency spend under 5% of total pay. ‘That’s not the end result we would like, but it is getting there,’ adds Mr Raymont.

Agency controls were introduced in October 2015, starting with ceilings for the amount of agency nursing expenditure as a proportion of total pay. These were quickly followed by a requirement to use only approved framework contracts for sourcing temporary nurse staff.

Then, in November the same year, price caps

were brought in for all staff groups. These rates were tightened in two further steps known as the ratcheting process. This meant that in April 2016 all rates were capped at 55% above basic substantive staff pay rates for the relevant roles. The 55% premium is calculated to cover holiday pay, employers national insurance and pension, as well as framework, agency and other fees. The idea is that the capped rates are effectively equivalent in cost terms for NHS employers as employing substantive staff and should provide little incentive for staff to opt for a temporary position over a full-time role.

Mandatory use of approved frameworks was extended to all staff groups in 2016/17, with ceilings set for total agency spend. This final measure was given real teeth by including performance against it as a metric in the single oversight framework’s use of resources assessment. Now poor performance on agency spending has a direct impact on assessment of overall financial performance and holds implications for greater scrutiny.

NHS Improvement believes the controls have been important in moving the balance of power away from agencies and back towards the NHS. Temporary staff remain an important resource for trusts to cope with varying levels of demand, meet short-term needs and cover vacancies. But there are concerns that in recent years it has become far too much of a sellers’ market.

In the long term, however, controls over spending levels and rates are not the answer. ‘The best solution is more substantive staff, but there are supply challenges that the whole sector is facing,’ says Mr Raymont.

He adds that the oversight body is working with royal colleges and others about how they get the right numbers in future. It also recently launched a new programme to help trusts improve retention levels particularly among nursing staff.

The UK’s exit from the European Union adds a further uncertainty over future supply of staff and the need for temporary cover. Recent reports have highlighted stark reductions in the number of registrations of EU nurses coming to work in the UK since last year’s Brexit vote.

Mr Raymont says it is not clear that this has had an impact on temporary staff spending already. But NHS Improvement is aware of the potential added pressure.

‘We are in a two-year period of negotiation before leaving the EU in April 2019,’ he says. ‘As we lead up to that date, it will be a potential time of risk. We are working with providers as much as we can.’

All of which means that keeping the pressure on to reduce agency spending is vital, given the current financial pressures.

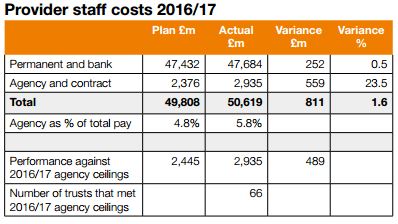

Spending on agency staff needs to be seen in the context of overall spending on pay. In 2016/17, providers’ total pay bill reached £51bn, £811m higher than plan and £1.8bn (3.8%) higher than in 2015/16.

Pay inflation pressures played a big part in this increase, with the combined impact of pay awards, pay drift and changes to pensions adding an estimated 3.3% to costs. So in fact the pay bill grew by just 0.5% in real terms in the context of a 2.4% growth in cost weighted activity. While that suggests a good result overall, NHS Improvement is adamant more can be done.

Permanent and bank staff spending was £252m above plan (0.5%) while agency and contract staff spending was £559m over plan (23.5%). And while 85% of providers reduced expenditure compared with the previous year, only 66 providers met their agency ceiling.

Medical locum costs are seen as a specific challenge, with staff shortages in emergency departments in particular driving the high spending. There are still some extraordinary rates being paid to some locums – up to £357 an hour in one case reported during the last financial year.

NHS Improvement wants to see £150m savings on medical locums in 2017/18 compared with the just over £1bn spent in 2016/17 (36% of total agency spending of £2.9bn).

Small changes can make big differences. Reducing the rate paid for medical and dental shifts over the price cap by just £1 per hour would save £8.7m a year. Do this across all staff roles, including nursing and administration, and the service potentially saves nearly £20m a year.

The push to reduce locum costs in 2017/18 faced challenge in the shape of new IR35 tax rules aimed at staff delivering services through personal service companies. Initial guidance from NHS Improvement had suggested that trusts would need to treat all locums as ‘inside IR35’ for tax purposes, but it later clarified that assessments should be on a case-by-case basis.

IR35 distraction

In some ways the IR35 issue has been a distraction from the main job of reducing costs. In fact the change initially led to some locums seeking higher rates to compensate for less favourable tax treatment and made some posts harder to fill.

NHS Improvement believes the sector at least now has a ‘good understanding’ of the rules, and it has urged trusts not to accept increases in locum costs beyond current levels as a result of any changes.

Mr Raymont says there is also an opportunity stemming from the IR35 changes. ‘Virtually all staff should be subject to the same rates of taxation, regardless of their method of engagement, which is expected to act as a major push factor for staff signing up to a revitalised NHS bank offer,’ he says.

While urging NHS providers to ‘go further’ in applying existing measures – including improving use of e-rostering, job planning and the turnaround of vacancies – new measures in 2017/18 aim to help organisations put more effort into reducing agency spend. These take the form of providing more scrutiny of current agency spend and encouraging greater use of in-house staff banks.

From April this year, trusts now have to report weekly on:

- Total agency shifts

- Breakdown of shifts by core and unsocial (medical) and by day, night/ Saturday and Sunday/public holiday (Agenda for Change)

- 10 longest serving agency staff

- 10 highest cost agency staff

- Shifts worked above £120 an hour, with evidence of sign-off

- Shifts off-framework and above cap, with evidence of sign-off

The data being requested is the type of data used by trusts that have significantly reduced agency spend,’ says Mr Raymont. He highlights good practice in one trust that has helped to reduce monthly spend on locums by more than £800,000 per month.

This has involved the medical director scrutinising all locum requests daily and removing the highest cost locums where appropriate, formalising the staffing request process, launching a new staffing framework and introducing rigorous governance around paying above price caps. This calls for executive sign-off and is only permitted for exceptional patient safety grounds.

Mr Raymont says that the key aim of the additional data collection is to improve visibility. ‘It allows us to get closer to what is going on in trusts – finding out more for example about [use of agency staff to fill] core and unsocial hours,’ he says, with agency staff typically making up a higher proportion of non-core shifts than core shifts.

NHSI is also keen to feed back this data to trusts to allow anonymous benchmarking via the Model Hospital platform.

However, Mr Raymont says the big push this year is around staff banks. Jim Mackey’s recent letter highlighted that, for the first time since the agency controls began, monthly agency spend was now less than bank spend. While he recognised this as a ‘great achievement’, the oversight body believes banks have an even greater contribution to make in reducing overall staff costs and improving quality.

‘We are looking for all trusts to have banks across all staff groups,’ says Mr Raymont. A recent stock-take has highlighted major variation across the country. ‘While almost every trust has a bank of one sort or another, some trusts don’t cater for particular staff groups,’ he says. So, for example, many trusts don’t have a bank for medical staff and not all have administration and clerical banks – despite this potentially being the easiest bank to set up and operate.

Mr Raymont acknowledges there is a market for outsourcing bank arrangements and accepts this may suit some organisations. But in general he is keen to see trusts investing more in their bank operations – the premiums being paid for locum staff provide a good cost-benefit argument for setting up an in-house medical bank.

As a start, he suggests banks remove any obstacles for staff to work through the bank rather than an agency. This might require mirroring agencies in meeting temporary staff preferences – the ability to book shifts using smart phones and weekly payment are good examples.

He also wants to see more collaboration across providers and areas, potentially linking individual organisations to a wider group of bank staff before having to consider agency supplied staff.

Overall it is case of more of the same and then push harder. ‘We need to make sure the existing controls continue to be applied,’ Mr Raymont says. ‘Keep going with them because there is a lot more we can do. And we can’t assume the savings are sorted. We need trusts to work with us on developing banks and make more inroads into the locum market.’

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.