Finance in profile

Finance staff numbers working in provider and commissioner organisations have remained relatively stable over the last 10 years despite structural reorganisations. The function is highly qualified, experienced and motivated. However, there remain issues with the most senior levels of finance teams not reflecting the make-up of the function as a whole, both in terms of gender and ethnicity.

These are the high-level messages in the latest finance staff census and staff attitudes survey looking at the NHS finance function in 2019. The census – a collaboration between the HFMA, the Skills Development Network and Future-Focused Finance – is conducted every two years and provides a detailed breakdown of the NHS finance function, looking at where people work regionally and by organisation type, qualification levels and the profile of finance teams in age, gender and ethnicity.

The HFMA staff attitudes survey complements this headcount analysis by adding in the views of a sample of the finance community.

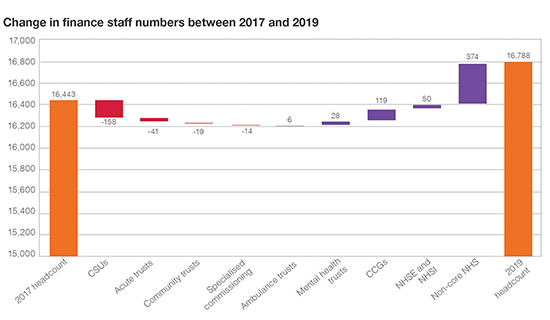

In total, the 2019 census recorded 16,788 finance staff across 507 organisations, including non-core bodies such as NHS Property Services and central and regional teams from NHS England and NHS Improvement. This represented a headline increase of 345, or 2%, since 2017 (see chart below), though this includes a rise of 374 staff in non-core bodies, the numbers of which differ from census to census.

Focusing just on the 226 provider bodies and 206 commissioning bodies (including clinical commissioning groups, commissioning support units (CSUs) and specialised commissioning teams), there were 15,035 staff in place at the end of June 2019. This represents a reduction of 716 staff in providers and commissioners since the census was first conducted in its current detailed format (broken down by Agenda for Change pay bandings) in 2009.

Some of the differences are down to the different treatment of specialised commissioning finance teams in different years. However, there was a significant drop in numbers in the 2013 census, reflecting the abolition of primary care trusts and strategic health authorities and the increased use of shared services, particularly by new CCGs.

But in the last three censuses, overall finance and commissioner finance staff numbers have remained broadly unchanged, around 15,000, despite there being 25 fewer organisations in 2019 compared with 2015.

Provider numbers

Looking at the 15,690 core NHS finance staff – those working in providers, commissioners, NHS England and NHS Improvement – four-fifths (12,545) work in provider bodies, with more than three-quarters of these (9,769) working for acute trusts. Mental health trusts account for a further 17% of provider finance staff, with community (400) and ambulance trust (287) making up the balance.

On average, an acute trust employs 66 finance staff compared with 40 for a mental health trust, 29 for ambulance and 25 in a community trust. These averages are distorted by the size of the organisations, with finance team size typically increasing with turnover. More than 100 of the 146 acute trusts have turnover of £300m or more. But just 14 of the 51 mental health trusts, and no community trusts, have turnover this size.

Taking into account turnover, average finance team sizes are more similar. For example, for a trust with a turnover of between £200m and £300m, the average finance team size is 46 (acute), 38 (mental health) and 38 (community). Use of shared services or outsourcing – or the provision of services to other NHS bodies – will also have an impact on finance team size. Four-fifths of all providers outsource one or more financial services. The most frequently outsourced service is internal audit (74%), but this is closely followed by payroll (62%) and accounts payable/receivable(48%/47%).

In the case of accounts payable and receivable, this reflects an increase since 2017, and there has also been a six percentage point increase in the number of providers outsourcing all of these functions.

Commissioning

Of the 2,490 staff working in commissioning, four fifths (2,050) work in CCGs with the remainder split between CSUs (402) and specialised commissioning (38). The average size of a CCG finance team is 11. This is a small increase in the average of nine in 2017, reflecting both a reduction in the number of CCGs (down 16 to 191) and a small increase in CCG staff overall (up 119).

The average size of a finance team varies depending on location – from seven in London to 20 in the South West. Looking at the numbers of staff in post per £bn of allocation, the average number of staff ranges from 17 in London to 40 in the North West.

Several CCGs were sharing chief finance officers (CFOs) and finance teams and many submitted a combined census return. This joint working was in some cases a precursor to mergers that have taken place since the census was completed.

The NHS as a whole faces significant staff shortages and the census suggests the finance function has its own challenges in this area, with a 7% vacancy rate, considering staff in terms of whole-time equivalents.

The census continues to show that the finance function is highly qualified and relatively senior. More than 40% of the function is band 7 or higher (including finance directors and senior managers not on Agenda for Change rates). London has the highest proportion of senior staff with 54% band 7 or higher. It also has the lowest level of staff in bands 1-4, possibly reflecting higher levels of shared service usage for transactional processing.

The majority of finance staff also have, or are studying for, some kind of finance qualification. Nearly one in three is qualified with the CCAB or equivalent body, while a further 12% are studying for this level of accountancy qualification. Some 12% are qualified or studying for AAT. Just over 40% of the function has no finance qualification.

For the first time this year, the census has also collected information about the age spread of the finance function. It shows that 57% of staff are aged between 35 and 54, with fewer than 20% 55 or older. Just 15% (745) finance managers in band 8a or higher are aged over 55. Looking specifically at finance directors, 23% are aged 55 or older and one in five is 44 or younger.

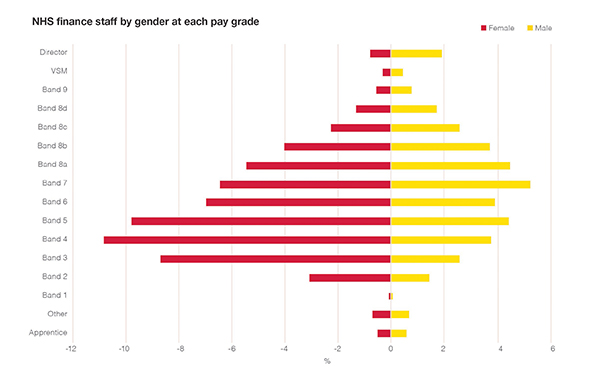

There may be a good age balance at director level, but the function still has work to do in having women properly represented at the most senior levels. Women make up 62% of the NHS finance workforce, but the position is exactly reversed for band 8d and above. And just 29% (132) of finance directors are women.

While this represents a step forward since 2009, when there were only 75 female finance directors, representing 21% of all directors, the improvement is more marginal compared with 2017. The 2019 numbers represent an increase of five director positions filled by women and just a one percentage point improvement.

Two-thirds of all women in NHS finance are at band 6 or below (45% of men). The change in balance between women and men as you move up the pay bands can be seen clearly in the chart below.

The census also highlights a continuing imbalance in the ethnicity of NHS finance staff, which increases with pay grade. Organisations chose not to disclose ethnicity for 6% of finance staff in total and 4% of directors – a smaller number than in 2017 – and the census reports the proportions of different ethnic groups as a proportion of all those for which information was provided.

Some 75% of NHS finance staff were white British (78% in 2017) – though this increases to 92% at director level. London has a different ethnic make-up, with just 36% of finance staff being white British. However, some 74% of finance directors in the capital are still white British. London organisations chose not to disclose the ethnicity for a higher percentage of all finance staff (10%) and directors (5%).

Figures published this year suggest that 20% of all staff working for NHS trusts and CCGs in England in 2019 were from a black and minority ethnic background. This compares with 22% of NHS finance staff at CCGs and 23% at provider trusts who are not from a white British background. Some 23% of women in NHS finance as a whole are of an ethnicity other than white British. The equivalent number for men is 29%. At more senior levels – band 8d and above – these proportions drop to 16% and 15%.

HFMA director of policy and research Emma Knowles says the census is an important way of tracking the finance function over time. ‘This was the original aim when we launched the census a decade ago – to see how the function changed in numbers and make-up as structures and the requirements placed upon it altered.

‘On the face of it, numbers have stayed relatively stable, apart from a reduction reported in the 2013 census largely related to commissioning changes. This reflects the important role undertaken by finance staff at all levels – it is an essential function playing a crucial part in the delivery of high-quality, sustainable services as well as supporting accountability arrangements. But there have been changes within the function.

‘For example, it is generally more qualified and more senior now than it was in 2009 – 43% of finance staff are now qualified with or studying for a CCAB qualification or equivalent. This rebalancing towards more senior staff reflects moves away from transactional processing – including the greater use of shared services in some cases – and towards more value-adding roles such as business partnering.’

Monitoring and remodelling

Ms Knowles believes that this monitoring of the function will continue to be important as the finance function looks to remodel itself to support greater system working and take advantage of technology developments.

The association published NHS finance: designing our future last December, in collaboration with Future-Focused Finance and PwC, to start a discussion about how the function needs to adapt, and the census will provide a mechanism for monitoring the impact of any changes.

However, Ms Knowles acknowledges that the census also highlights where NHS finance needs to do better. ‘The NHS finance function continues to have a diversity problem in higher paid roles when looking at gender and ethnicity,’ she says. ‘The finance function and the NHS is poorer for not reflecting the communities it serves.’

The function has started to address the diversity issue – with work being led by Future-Focused Finance – the census is a reminder that there is still a long way to go.

Career focus

More than two-thirds think NHS finance offers sufficient career development opportunities. But some identified limited scope for progress in their organisation and few opportunities for secondments.

Finance staff feel positive about their roles, scoring an average of 6.9 out of 10 for job satisfaction – reversing a downward trend from previous surveys. In general, job satisfaction rises with age. Although 69% would like to spend the rest of their career in the NHS, only 52% expect to do so. In terms of working hours, 70% of staff work in excess of their contracted hours at least once a week and one in five say they always work in excess of contracted hours. Close to two-thirds of respondents think NHS finance is more stressful now than in previous years.

Views on how finance is valued have changed little from previous surveys. The vast majority (88%) think their finance team adds value to the organisation – although better communication with non-finance staff and improved financial literacy of non-finance staff would increase that value.

Almost half feel valued by their board, but more than a third do not feel valued by the government and health department. However, people felt drawn to the NHS because it fits with their public sector values.

Looking to the future, 40% of the sample thought the finance function needed to be bigger to meet demands placed on it. However, 45% thought it would be smaller by 2022/23.

Related content

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.

This event is for those that will benefit from an overview of costing in the NHS or those new to costing and will cover why we cost and the processes.